Snakebit: COBRA Subsidies in the COVID Relief Bill Would Pay Health Insurers to Double-Dip in a Pandemic

Health insurance corporations are making bumper profits because of this pandemic. Now they want the American taxpayer to pay for COBRA coverage too.

I support almost every proposal in President Biden’s American Rescue Plan...except one: COBRA subsidies for health insurance corporations.

Here’s where we are: We’re the only high-income country in the world that predicates health insurance on employment through employer-sponsored private health insurance. So during the pandemic when nearly 15 million people lost their jobs, they lost their health insurance, too. Despite this national uninsurance crisis, health insurance corporations are making bumper profits—billions more than even they expected to make.

You could imagine a scenario where health insurers decided that they should do their part to keep Americans insured—I can see the headline: “Health insurers pledge to keep Americans insured through the pandemic.”

That didn’t happen. Instead, they’re now asking you and I, the American taxpayer, to pay for the perversity of the system where people lose their health insurance and the insurance companies make more money. Again.

Since nearly the beginning of the pandemic, insurance companies have been lobbying Congress to respond to the uninsurance crisis by offering Americans who’ve lost their insurance subsidies for COBRA—post-employment private health insurance which is usually far more expensive than the usual monthly premiums (because they’re no longer paid in part by one’s employer). Indeed, a first round of COBRA subsidies was passed back in May. And now they’re back for a second round. The Administration’s $1.9 Trillion “American Rescue Plan” includes $57 Billion for COBRA subsidies.

Before anyone goes accusing me of being against the COVID-19 relief package, let me be clear: we need action now. We’ve needed action. And for the most part, I agree with both the size and scope of the package. Just not COBRA. It’s a blatant giveaway to health insurance corporations to do a thing they should have done in the first place!

Rather than give billions more to corporations that have already made billions more during the pandemic, why not enroll the newly uninsured in government programs like Medicare or Medicaid by extending access to these programs to people who’ve lost their insurance? Rep. Pramila Jayapal’s Medicare Crisis Program Act proposes exactly that. It’s not impractical—it’s obvious. We should be empowering Americans who have been failed by the private insurance industry through reliable healthcare access rather than empowering the very corporations responsible for failing them.

One of the hallmarks of this pandemic is that it’s made the rich richer, and the poor poorer. Paying health insurance corporations who’ve already profited handsomely off this pandemic to do what they should have done in the first place simply accelerates that.

Why is Health Insurance So Profitable in a Pandemic?

Few industries have profited as handsomely from the pandemic as Big Health Insurance. Anthem more than doubled its profits in the second quarter of 2020, making a whopping $2.3 Billion. UnitedHealth made $3.3 Billion more that quarter compared to 2019.

You might be thinking “but so many people got sick and so many people lost their insurance—how could health insurers make more money?”

First, the most expensive healthcare that insurers have to pay for are elective procedures—things like knee replacements and dermatologic procedures. But because these elective procedures were canceled in the first and second quarters of 2020 because of the pandemic, the insurance corporations got to keep that money as profit. Insurers call the money they actually have to pay for healthcare costs “medical loss,” and 2020 saw record low “medical loss ratios.”

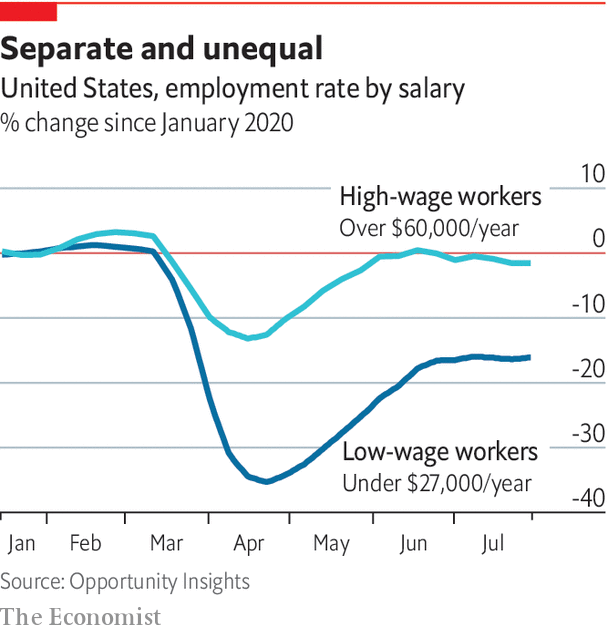

Second, the customers health insurers lost were their most expensive to insure. Let’s look deeper at the nearly 15 million people who lost their health insurance: They weren’t the highest paid folks, most of whom could move their work from behind a computer in a high-rise office building to...behind their computer at home. The White Collar workforce was largely unaffected by the pandemic. Rather, they tended to be lower-income workers.

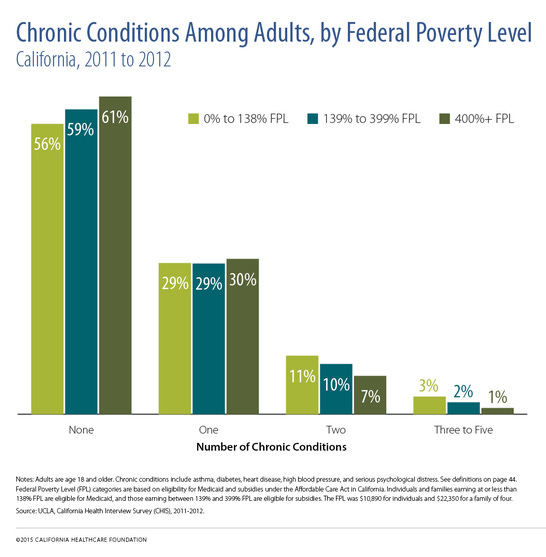

And it is an abiding truism of epidemiology that lower-income people tend to be sicker. For example, in California in 2011 and 2012, compared to lower-earning people, those making more than 400% of the federal poverty line were more likely to report having no chronic conditions, and less likely to have multiple conditions if they had any at all.

If you connect the dots, you can appreciate how losing customers didn’t really hurt the health insurance industry’s bottom line: The people who got kicked off their insurance roles were the ones most likely to get sick—and to cost the health insurers the most money. They were the insurers’ most costly customers precisely because they need healthcare most. And rather than insure them through high-quality public insurance programs, the insurance lobby wants us to pay the health insurers to cover them.

In the end, we need COVID-19 relief and we need it now—the American Rescue Plan should pass, even if we can’t fix the COBRA bite. But we may need COVID relief again. And next time, let’s leave out the snakes?